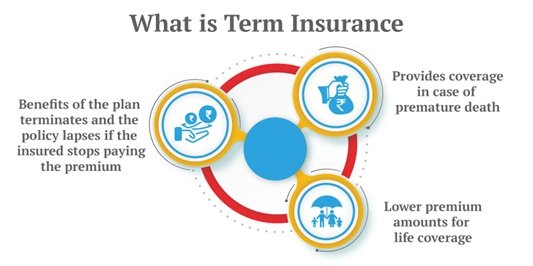

A term insurance plan is one of the most affordable ways to secure your family’s financial future. It provides a high sum assured at a relatively low premium, ensuring that your loved ones remain financially stable in your absence. However, the premium rates for best term insurance plans can vary based on multiple factors such as age, health, lifestyle, and policy features.

If you’re looking to secure a policy at the best possible premium rates, here are some essential tips to consider.

1. Buy Term Insurance at a Young Age

One of the most effective ways to get lower premium rates is to purchase term insurance early. Insurance companies determine premiums based on risk assessment, and younger individuals pose a lower risk due to fewer health complications.

For instance, a 25-year-old purchasing a ₹1 crore term plan will pay significantly lower premiums compared to a 40-year-old opting for the same coverage. The earlier you invest in a term insurance plan, the more cost-effective it will be.

2. Opt for a Longer Policy Term

The policy term plays a crucial role in determining the premium rates. Choosing a longer tenure ensures that you get coverage at a fixed premium for an extended period. If you opt for a shorter tenure and later decide to renew the policy, the premiums will be much higher due to increased age and potential health risks.

Example:

- A 30-year-old purchasing a 30-year policy will lock in a lower premium for the entire term.

- If the same person buys a 10-year plan and renews it at 40, the new premium will be significantly higher.

Opting for a long-term plan early in life helps you save on premiums in the long run.

3. Maintain a Healthy Lifestyle

Insurance companies evaluate health risks before determining your premium rates. Leading a healthy lifestyle can help reduce your premiums by lowering the risk factors associated with various diseases.

- Avoid Smoking & Alcohol Consumption: Tobacco and excessive alcohol use significantly increase health risks, leading to higher premiums.

- Maintain a Healthy Weight: Obesity and related health conditions can increase your insurance costs.

- Regular Medical Checkups: Keeping track of your health and managing any medical conditions early can ensure lower premium rates.

By staying fit and healthy, you present a lower risk to insurers, making you eligible for better premium rates.

4. Use a Term Insurance Calculator for Comparison

A term insurance calculator is a valuable tool that allows you to compare premium rates for different policies based on your age, coverage amount, and tenure.

Benefits of Using a Term Insurance Calculator:

- Helps in comparing multiple plans before purchasing.

- Provides an estimate of premiums based on different factors.

- Allows customization of coverage, riders, and tenure to find the most cost-effective option.

Before purchasing a term plan, use an online calculator to explore different premium rates and select the best-suited policy.

5. Choose the Right Sum Assured

While selecting a high sum assured ensures adequate financial protection for your family, it is essential to strike a balance between affordability and coverage.

How to Determine the Right Sum Assured?

- Experts recommend opting for 10-15 times your annual income as coverage.

- Factor in outstanding loans, daily expenses, and future financial goals such as children’s education and marriage.

- Use an insurance calculator to determine the optimal sum assured based on your financial needs.

Selecting an adequate but realistic coverage amount helps you get a plan with the best premium rates.

6. Choose a Basic Term Plan Without Excessive Riders

Riders are add-ons that enhance your policy coverage, but they also increase the premium amount. While some riders like critical illness cover and accidental death benefit are useful, adding too many riders can make your policy expensive.

How to Select Riders Wisely?

- Choose only the most relevant riders based on your personal needs.

- If you already have separate health or accidental coverage, avoid overlapping riders.

- Compare the additional cost of riders and ensure they provide real value.

Opting for a basic term plan with essential riders can help you keep the premium cost under control.

7. Pay Premiums Annually Instead of Monthly

Most insurance providers offer flexible premium payment options – monthly, quarterly, half-yearly, or annually. Choosing the annual premium payment option often results in lower overall costs as insurers may offer discounts for lump sum payments.

If you can afford to pay annually, it is a smarter choice as it minimizes administrative costs and reduces the total premium paid over time.

8. Avoid Delays in Policy Renewal

Missing premium payments or allowing your policy to lapse can lead to higher renewal premiums or even the need for a fresh medical check-up. If your policy lapses, you might have to:

- Pay higher premiums when purchasing a new policy.

- Undergo fresh medical evaluations, which could lead to increased rates if new health issues arise.

Always pay your premiums on time to maintain lower rates and ensure uninterrupted coverage.

9. Choose an Online Policy for Better Discounts

Buying term insurance online can be more cost-effective than purchasing through offline agents. Many insurance providers offer:

- Lower premium rates due to reduced administrative and distribution costs.

- Instant policy issuance with minimal paperwork.

- Easier policy comparison through online platforms.

If you’re looking for the best premium rates, consider purchasing your term plan directly from a trusted insurer’s website.

10. Compare Different Insurance Providers

Insurance companies have varying premium rates for similar coverage. Before finalizing a plan, take the time to:

- Compare multiple insurers’ offerings.

- Check the Claim Settlement Ratio (CSR) to ensure reliability.

- Read customer reviews and policy benefits carefully.

Choosing a provider with competitive premiums and a high claim settlement ratio ensures both affordability and security.

Final Thoughts

Securing the best premium rates for your term insurance plan requires strategic planning, timely investment, and maintaining a healthy lifestyle. By starting early, selecting the right coverage, using a term insurance calculator, and comparing different policies, you can find a plan that offers the best protection at the most affordable rate.

Making informed choices today can help you secure a financially stable future for your loved ones while keeping your premiums manageable. So, take the first step, explore your options, and invest in the best term insurance plans that suit your needs!